What’s Behind Fashion Subcontractor Scandals?

The Great Inversion and Why Fashion Doesn’t See the Problem

On December 4, 2025, Italian labor police visited the headquarters of 13 luxury fashion brands, including Gucci and Prada, to collect supply-chain, governance, and risk-management documents on subcontractors. Recently, luxury fashion has been under a spate of investigations and fines, which suggests exploitation is more a predictable result of strategic blindness than random ethical failures. Italy is asking, in effect, whether luxury fashion is choosing legal compliance or willful ignorance. The explanation lies in strategic mistakes and using Web 2.0 thinking on Web 3.0 tools. Here’s what everyone misses.

The better question is why fashion (luxury is the first mover), spends hundreds of millions on blockchain technology for marketing and authentication—that still leaves making in darkness. If blindness is no longer a technical limit, what happened? Fashion’s problem today is they chose the wrong technology path. The problem going forward is that investments that can’t see informal ecosystems are sunk costs.

The issues under investigation sit outside fashion systems. Those systems weren’t built to see work—not because they couldn’t, but because information asymmetry creates pricing power. Opacity is more profitable than transparency because it lets brands control narratives, margins, and market access. Fashion monetized the blindness. Paying fines costs less than building traceability, which exposes legal risk and damages brand value.

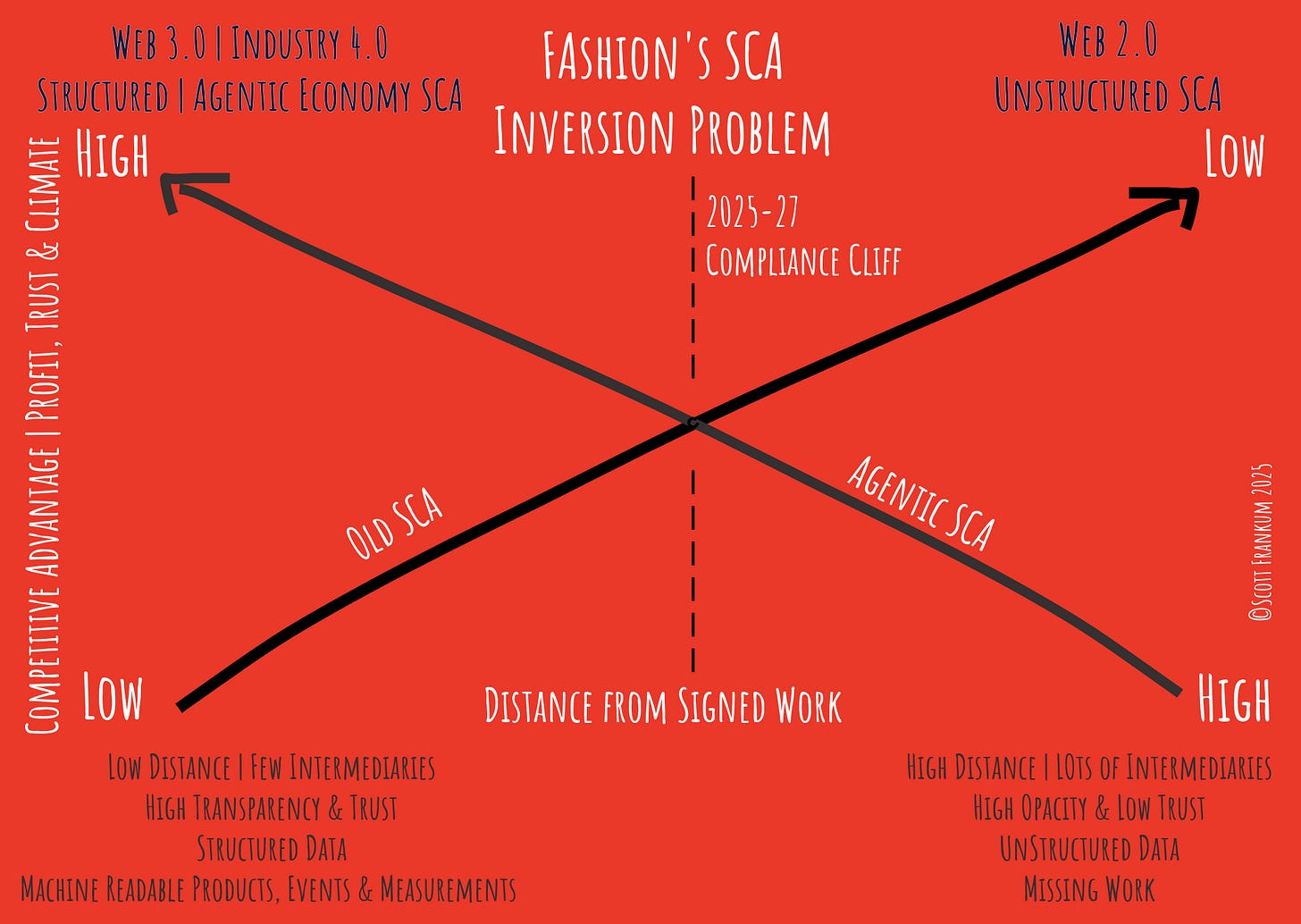

Recent climate regulations and AI/blockchain innovations change the structure of value creation. Fashion’s agentic economy architecture begins with truth in data, logic, and experiences. The real risk now is structural exclusion from AI discovery and sales. When climate legislation is active, the strength of a firm’s Sustainable Competitive Advantage, (SCA) becomes inversely proportional to the distance between signed work (truth/trust) and value creation. Luxury fashion is running out of excuses.

THE GREAT INVERSION

Fashion hid behind sunglasses for decades. The lights just came on.

This graphic shows the Great Inversion. The X-axis measures distance from signed work — how far a firm’s data sits from where value is created. The Old Sustainable Competitive Advantage line rewarded that distance. Opacity and unstructured work data increased margins. Spending on ERP, audits, certificates, and private blockchains are now sunk costs.

After the 2025–27 compliance cliff, advantage moves to the Agentic SCA line. Firms that structure work as signed, machine-readable JSON-LD products, events, and agents get recommended, regulators trust, and customers choose. The only rational move now is to stop feeding Old SCA and build on Agentic SCA.

THE CORE PROBLEM | TECHNOLOGY CHOICES

The core problem is that fashion systems cannot see the messy physical reality of work, culture, and daily life. That blindness drives the failures now under investigation. Most luxury brands use Ethereum-style blockchains and data formats built for control and marketing—not for high-trust supply chains or regulatory scrutiny. These blockchains-for-money are great for authenticity and value transfers, but leave work invisible.

Real production—product details, labor conditions, transformation events—lives in the informal economy of workshops, side subcontractors, and paper trails the fashion’s tech choices cannot read. Fashion carries two technology debts: old technology (legacy ERP) and wrong technology (data formats incapable of seeing work). Together they leave fashion structurally blind to informal ecosystems—indirect subcontractors, unauthorized workshops, and exploitative labor. Brands filled gaps with stories, labels, approved-factory lists, and audits to compensate for what they could not see or structure.

Structured work data, not structured supplier data, drives future advantage. Legacy Enterprise Resource Planning platforms can see suppliers and transactions, but not work or the messiness of life. This is not “bad records” but a design choice that keeps informal data, climate remediation, fairness, the whole list of UN Sustainable Development Goals…outside the data model. To maintain a see-no-evil stance, brands rely on marketing claims to elide inconvenient histories. Strategic blindness and fines cost less than operational changes and structured data work that would expose liability and damage brand value—until now.

Both the old ERP stacks and the JSON/JSON-RPC blockchains share the same flaw: they structure agreements, not work. Orders, payments, and shipments answer “Did money move? Did goods move?” The investigated companies use Ethereum-style blockchains and data formats that keep informal work invisible.

DATA FORMATS

Data formats determine what fashion can “see”. JSON and JSON-RPC, the formats fashion uses, store data in silos. A JSON record says “Supplier X delivered 1,000 units.” It is structured and machine-readable, but it only captures agreements. Work stays invisible.

JSON-LD is a data format that links across systems to understand who did what, where, and when. Fashion avoided this level of context for decades—because once you document labor violations, you own them. A JSON-LD record can express “Worker A completed 50 units at Workshop B on December 3, using Material C from Source D under conditions E.” Each element—worker, location, materials, conditions—becomes accountable. Strategic ambiguity kept brands safe. Paying fines costs less.

Blockchains-for-money use JSON and JSON-RPC because they secure and transfer value. Blockchains-for-commons and Digital Public Infrastructure projects often use JSON-LD because it is flexible enough to document work and daily life. The whole point of emerging standards is to reduce greenwashing and information asymmetry by documenting interoperable environmental and circularity data.

The EU’s Digital Product Passport names JSON-LD for cross-border trade because its linked data structure enables circularity and agentic interactions. JSON-LD gives recyclers a clear view of material compositions and provenance across many systems. AI agents can check real-time product data instead of relying on marketing claims. Digital Public Infrastructure makes signing data at the point of value creation cheap, so informal economies can participate without GS1 fees or corporate integration.

Gucci, Prada, and the others are very sophisticated companies that know how to use data for marketing and inventory management. Why are supply chains different? Why did fashion choose to manage reputational risk, not structural risk? Protocol networks and Digital Public Infrastructure make informal economies visible. Private blockchain tracing projects like the Aura Blockchain Consortium (including Loro Piana and Tod’s) prioritize marketing capabilities over legal compliance and ethical management. In other words, blindness is a feature of legacy data architecture, not a bug.

Once this infrastructure is in place, blindness is no longer a technical limit. It is a deliberate choice that creates legal risk in major markets and structural exclusion from an agentic economy that cannot use unstructured data.

THE NEW ECONOMIC CALCULUS

Climate regulations and the $3 to $5 trillion Agentic Economy invert the economic calculus. They turn opacity from a source of profit into an existential liability. Paying fines was a rational choice that cost less than building real traceability. Today, non-compliance blocks geographic and agentic economy market access.

Historically, opacity was how brands made money and built brand. But 2026 climate legislation in the EU, California, Australia, and other jurisdictions inverts economic rewards and rewires cost structures. When opacity becomes a regulatory risk, legacy firms must rebuild their data architecture to convert messy unstructured data into JSON-LD formats. Simply paying fines is no longer a rational economic decision.

Firms built for Yesterday’s SCA must rethink their value architecture across three layers — data, logic, and experience — or face exclusion from the Agentic Economy.

STRUCTURED DATA VS UNSTRUCTURED DATA

Structured data uses a spreadsheet-like format that machines read with clarity and speed. AI agents, regulators, and customers need to begin with high-trust data, or the agentic economy doesn’t work.

We understand that spreadsheets have clear context, structure, and meaning. The thing we miss is that data formats use titles, rows, and fields to map chaos, which determines whether we capture the messy physical reality of work, culture, and daily life. Legacy ERP and Ethereum-style systems use JSON/JSON-RPC to capture transactions. JSON-LD captures life.

Unruly. Illogical. Beautiful. Machines can only search, group, and analyze work once the data has structure. JSON and JSON-RPC capture tidy agreements. But work demands the facts of who did what, where, when, under what conditions, with which materials, and why these details matter. Fashion left work in the dark by choosing JSON and JSON-RPC. In Italy, this gap hid the unauthorized workshops, labor violations, and subcontracting chains now under investigation—and explains the scandal.